Natural Deposits Of Lithium (Li) Mineral In Nigeria

If you are curious about Nigeria’s natural treasures and how they can shape our future, the lithium deposits scattered across this country are a topic worth exploring with your friends or family.

Tucked away in states like Nasarawa, Kogi, Kwara, Ekiti, and beyond, this soft, silvery-white metal known to scientists as “Li” on the periodic table holds big promise for Nigeria’s growth, especially with the world’s eyes on clean energy today.

Known locally simply as lithium ore, it is a mineral that shifts from shiny silver to dull grey when it meets moist air, a sign of its lively nature. Whether you are a Nigerian looking to grasp what is beneath our soil or someone keen to explore how Nigeria fits into the global resource map, this guide spills the gist on lithium’s history, where it hides, and why it matters more than ever. Let’s dive into this mineral’s tale and see how it can light up Nigeria’s path forward.

A Glimpse into Lithium’s Roots

Lithium deposits in Nigeria have been part of the land for millions of years, locked in ancient rocks called pegmatites that formed during the Pan African geological shake up around 600 million years ago. Local tales might not pinpoint when folks first stumbled on it, but serious mining chatter kicked off around 2018, when Nigeria’s Geological Survey Agency started mapping out high grade finds across the country.

These silvery treasures stayed quiet for ages, mostly overshadowed by Nigeria’s oil boom since the 1960s—until the world’s thirst for electric car batteries and gadgets turned eyes to lithium. Now, places like Nasarawa and Kwara are buzzing with prospectors, and Nigeria is waking up to a mineral that could shift its fortunes. It is a story of old rocks meeting new dreams, rooted deep in our soil.

Availability of Mineral Deposits

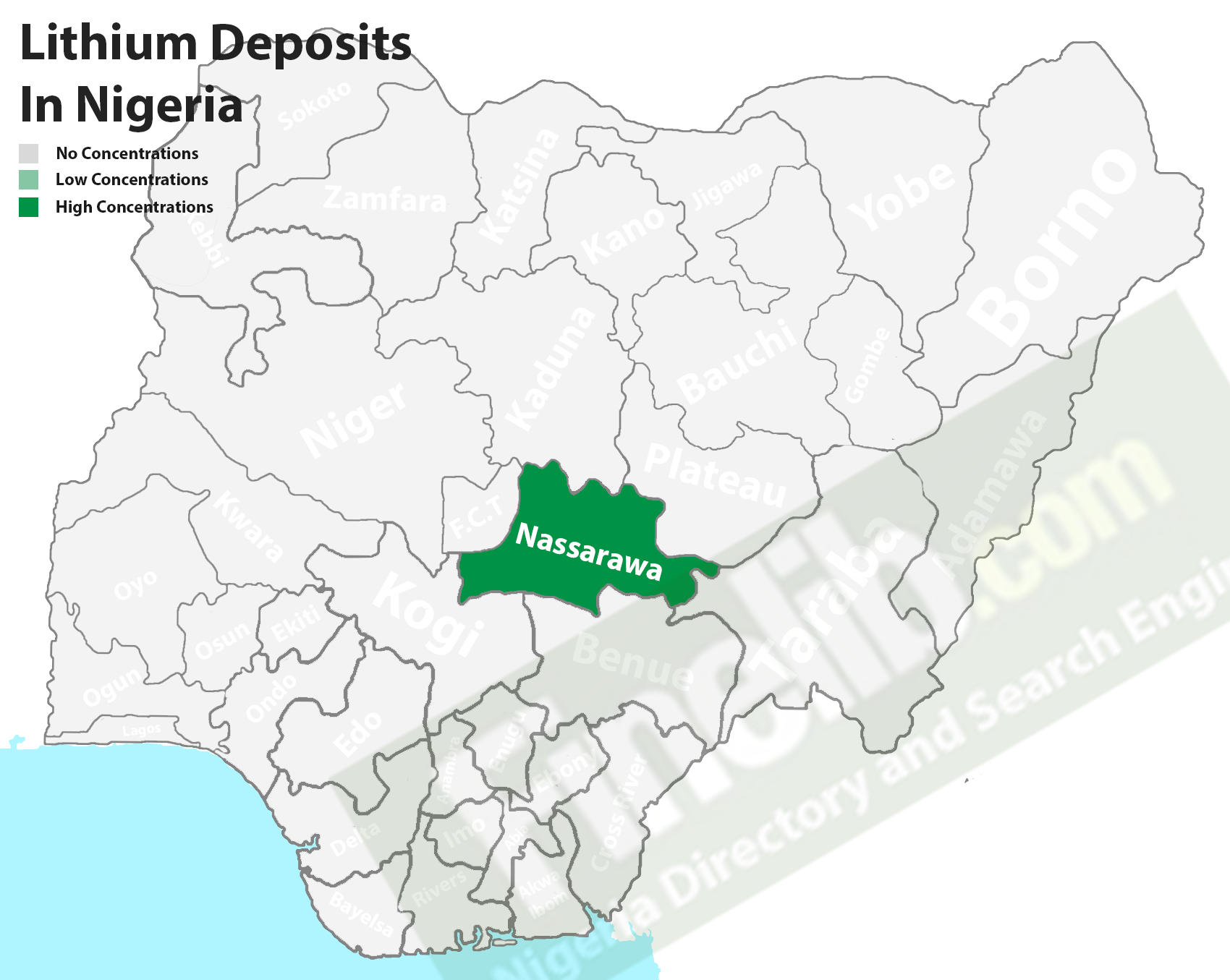

Lithium is no small deal in Nigeria—it pops up in at least ten states, with big deposits confirmed in Nasarawa, Kogi, Kwara, Ekiti, Oyo, Kaduna, Cross River, Bauchi, Niger, and the Federal Capital Territory. Smaller prospects tease miners in states like Edo and Taraba, stretching across a 450-mile belt from Nigeria’s southwest corner up to Kano in the north, a zone experts call the “Lithium Belt.”

This belt sits in the Basement Complex, a massive rock layer covering half of Nigeria—where pegmatites cradle lithium minerals like spodumene and lepidolite in chunky crystals or felted clumps. You will not find it lying around loose; it is always locked in these rocks, waiting for miners with the right tools to crack it open. Nigeria’s got plenty of it, spread wide enough to keep explorers busy for years.

Where It Hides

Finding lithium in Nigeria means heading to places like Keffi in Nasarawa, where lepidolite reigns, or Oyo’s southwest corner, where spodumene takes the lead—each spot has its own mineral vibe. Kwara’s rolling hills hide spodumene rich pegmatites, while Kogi and Ekiti lean towards lepidolite laden rocks, a pattern geologists call “regional zoning” that shows Nigeria’s diverse underground mix.

From Lagos, it is a trek—take a bus to Ibadan for 2000 naira, then hop an okada to Kwara’s mining zones for another 1000 naira—or from Abuja, a taxi to Nasarawa’s Keffi runs about 3000 naira. These deposits nestle in rural corners, often near villages like Angwan Doka or Gidan Kadiri, where the land’s quiet belies the riches beneath. It is Nigeria’s hidden stash, waiting for those who know where to look.

Potential of the Reserves and Their Uses

Nigeria’s lithium reserves pack serious potential—some pegmatites hit grades as high as 13% lithium oxide, far above the global 0.4% mining cutoff, with averages around 3.5% that promise big yields. That is enough to power millions of electric vehicle batteries, smartphones, laptops, and solar storage systems—stuff the world craves as it ditches fossil fuels.

Beyond gadgets, lithium fluoride crafts clear lenses for fancy optics, and lithium carbonate helps make ceramics tougher or medicines for mental health—uses that could spark industries right here in Nigeria. With demand set to soar 500% by 2050, according to the World Bank, these reserves could turn naira into billions if Nigeria plays its cards right. It is a mineral with muscle, ready to flex for our economy.

Geological Surveys and Mapping Data

The Nigerian Geological Survey Agency has been on the case since 2018, mapping lithium across that 450 mile belt with tools like drills and ground scanners to pinpoint high grade zones. They have tagged spots like Nasarawa’s Keffi district—rich in lepidolite—and Kwara’s southwest, where spodumene dominates, building a treasure map of Nigeria’s lithium wealth.

This data shows pegmatites tied to ancient faults and shears, part of a “Lithium Cesium Tantalum” family that also packs rare metals like niobium and tin—extras that sweeten the pot. Surveys say Nigeria’s belt links to Brazil’s pegmatite province, hinting at a shared geological past that could guide miners here. It is solid science lighting the way for Nigeria’s lithium boom.

Environmental Impact Assessments

Mining lithium in Nigeria is not all rosy—digging pegmatites can scar the land, kick up dust that chokes air, and leak chemicals into rivers if not handled sharp. In Nasarawa, locals near Keffi already grumble about muddy streams from small scale digs, a sign Nigeria needs tight checks to keep its green hills safe.

Assessments must weigh water use too processing lithium guzzles plenty, and in dry zones like Kaduna, that could strain local supplies without proper plans. Deforestation is another wahala. Clearing forests for mines could shrink habitats for birds and critters, so Nigeria must balance the gain with the pain. It is a call to mine smart, not just fast.

Access to Raw Materials for Manufacturing

Right now, Nigeria ships raw lithium out—tons head to China or Europe—but keeping it home could fire up manufacturing here instead. With access to spodumene and lepidolite, factories could churn out batteries for electric okadas or solar kits for villages, cutting the cord on imports that drain our naira.

Nasarawa’s deposits are just 150 kilometres from Abuja—close enough for plants to tap raw ore without long hauls—while Kwara’s nearness to Lagos could feed tech hubs down south. Roads and rails need work, but the stuff is there, waiting for Nigeria to grab the chance. It is raw wealth ripe for turning into finished goods.

Biodiversity and Conservation Efforts

Awhum’s forests and Kwara’s hills host birds, monkeys, and rare plants—mining lithium risks chopping that down if Nigeria does not watch out. Conservationists say pegmatite zones overlap with biodiversity hotspots, so carving them up could push species like the grey parrot closer to the edge.

Efforts are spotty—some call for “green mining” with tree replanting or no go zones, but cash strapped states often prioritise digging over saving. Nigeria could learn from places like Australia, blending mining with nature parks, to keep its wild side alive. It is about digging without wrecking what makes Nigeria special.

Sustainable Resource Management Practices

Sustainable lithium mining in Nigeria means planning smartly to use less water with recycling tech, cutting dust with covers, and replanting trees after digging to heal the land. Setting quotas could stop over mining, say, cap it at what keeps reserves for 50 years—while training locals as rangers curb illegal grabs.

Sharing profits with villages like Angwan Tudu could fund schools or wells, keeping folks on board instead of fighting miners. Nigeria’s got to mix grit with care mine today, thrive tomorrow, learning from oil’s messy past. It is a way to win big without losing bigger.

Investment Opportunities in Resource Extraction

Lithium’s boom opens doors for investment. Big players like China’s Ganfeng are sniffing around, but Nigeria could lure more with tax breaks or solid roads to Kwara and Nasarawa. Small-scale miners need gear, think drills or trucks, and foreign cash could kit them out, turning local hustle into big gains.

Battery plants are the prize investors could build near Ekiti’s deposits, churning out power packs for Nigeria’s growing tech scene. With lithium prices jumping from £4600 per tonne in 2020 to £61000 in 2022, the naira potential is massive if Nigeria grabs it. It is a goldmine for those with vision and cash.

Government Policies and Regulations

Nigeria’s Ministry of Mines and Steel Development runs the show. The 2007 Nigerian Minerals and Mining Act says all minerals belong to the Feds, so miners need licenses like the Exploration Permit (three years) or Mining Lease (25 years). Rules tightened in 2023—no raw lithium export without local processing, pushing firms to build plants here, not just dig and dash.

The Mining Cadastre Office hands out permits, but corruption and weak checks let illegal miners slip through, especially in Nasarawa’s bush. Policies aim to curb that 2,200 mining marshals nabbed 32 dodgers in 2024, yet Nigeria needs sharper enforcement to lock it down. It is a law with teeth if Nigeria bites hard.

Benefits of Refining and Producing in Nigeria

Refining lithium here before export could turn Nigeria into a battery boss. Process spodumene into lithium carbonate locally, and you are selling high-value goods, not cheap rocks. That keeps more naira home. Raw ore fetches £100 per tonne, but refined lithium oxide hits £20000 meaning jobs for welders, chemists, and drivers, too.

Building plants in Kwara or Kogi cuts shipping costs. Why send them to China when Lagos techies can use them? It also powers Nigeria’s own electric buses or solar grids first. It dodges export taxes abroad and builds skills. I think Nigerian engineers are running the show, not just foreign hands. It is Nigeria cashing in big by keeping the good stuff close.

The Bigger Picture

Lithium deposits are Nigeria’s ticket to a new game tucked in ancient rocks; they hold power for a world, ditching oil for green juice. As Nigeria rolls into 2025, this mineral could shift us from crude kings to battery champs, if we mine it smart and keep it sustainable.

It is not just Ogun or Nasarawa’s pride. It is a nod to Nigeria’s untapped wealth, showing the world we have minerals worth shouting about. From its quiet past to a buzzing future, it is a tale of grit, growth, and green promise that could keep Nigeria shining. It calls us to dig, refine, and rise at home.